Why Dawkins Advisory Group

Specialize in supporting Family Assets

Our primary specialty is guiding families with assets between $100M-$250M.

Proactive vs. Reactive model

Dawkins Advisory takes a proactive approach to ensure that the latest Addepar feature updates and organization best practices are implemented for our partners.

Efficient workflows & expedited onboarding

Our templated, scalable workflows allow us to quickly develop a baseline for performance reporting and customization needs.

Dawkins Advisory works exclusively with Addepar. Our Addepar expertise is solely focused on implementing the latest feature updates and delivering evolving analytics and reporting.

Addepar's secure platform provides robust data aggregation, reporting, and customization capabilities that serve as Dawkins Advisory Group's foundation for building individually tailored workflows that meet families' unique needs.

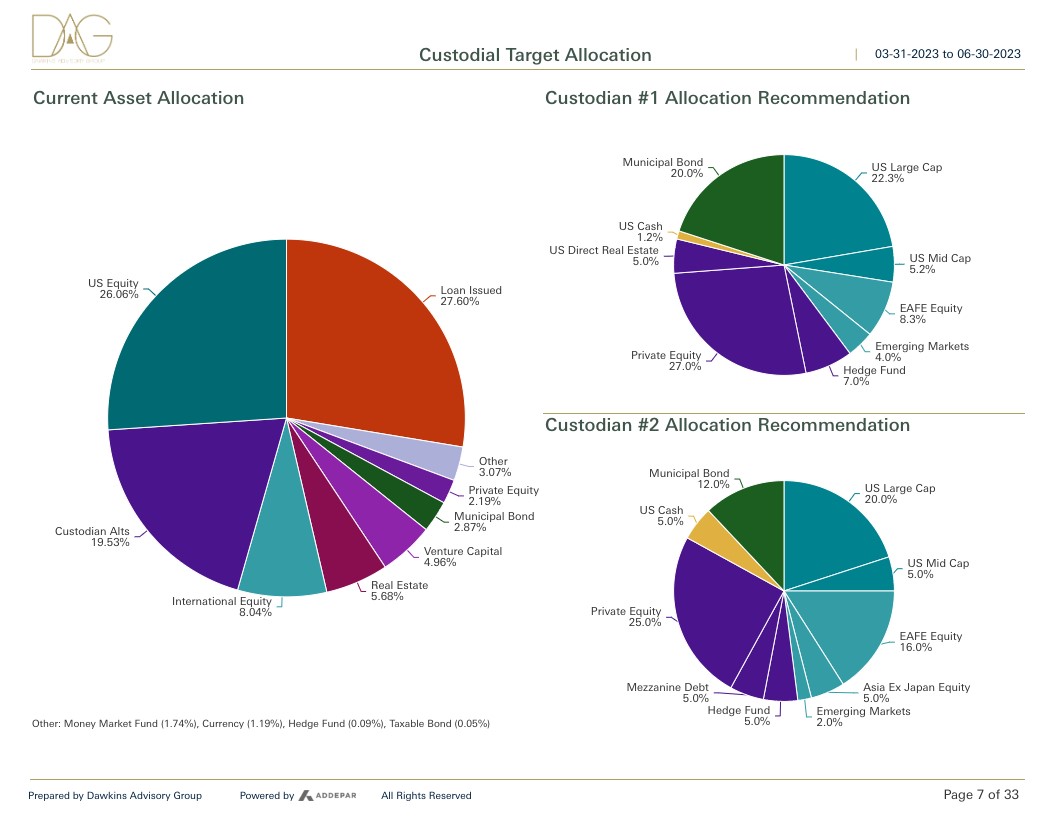

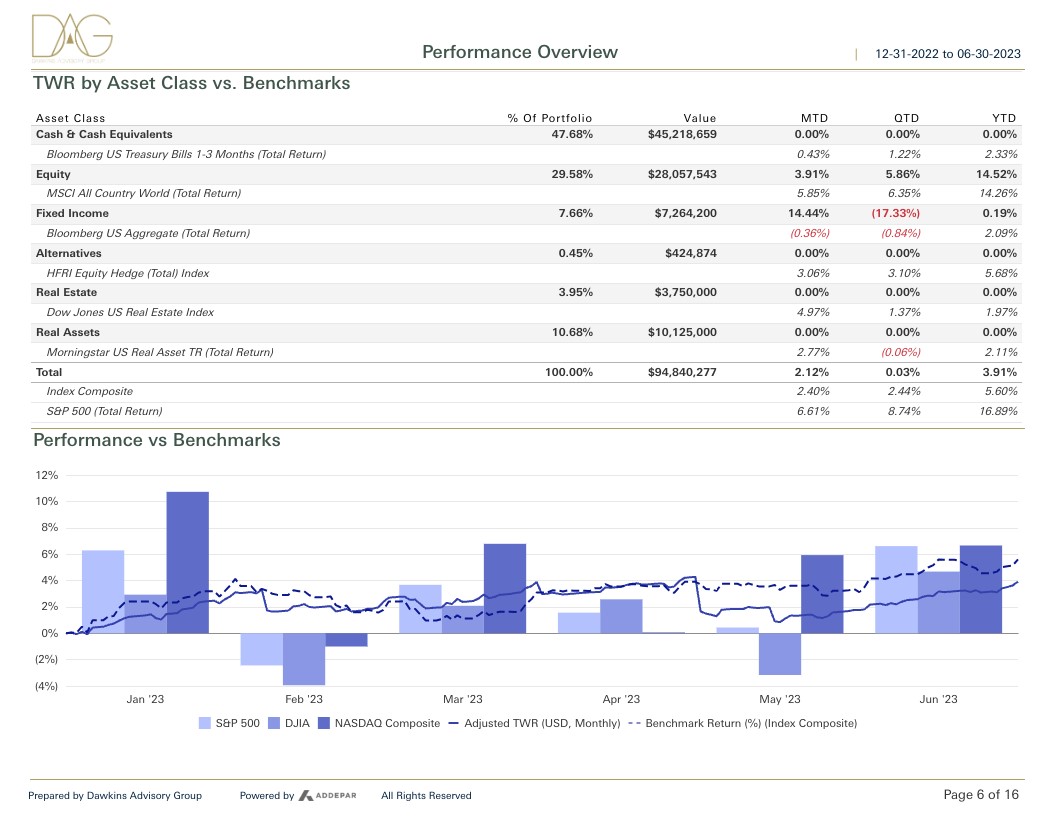

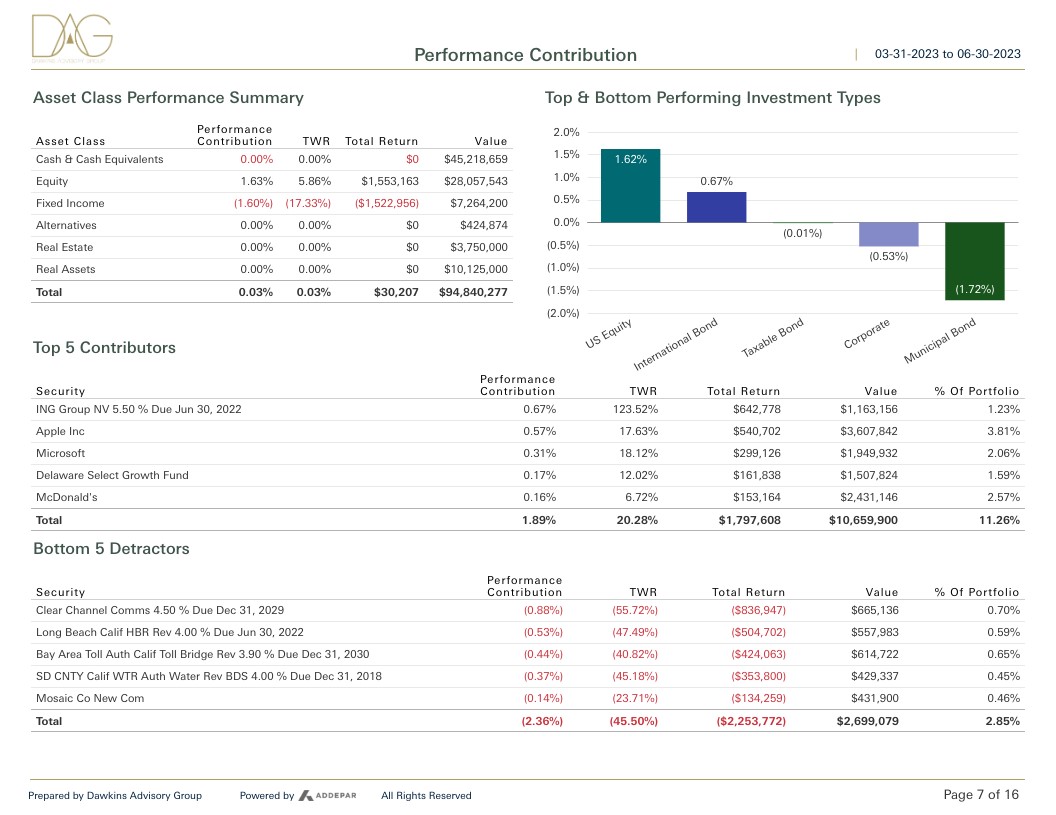

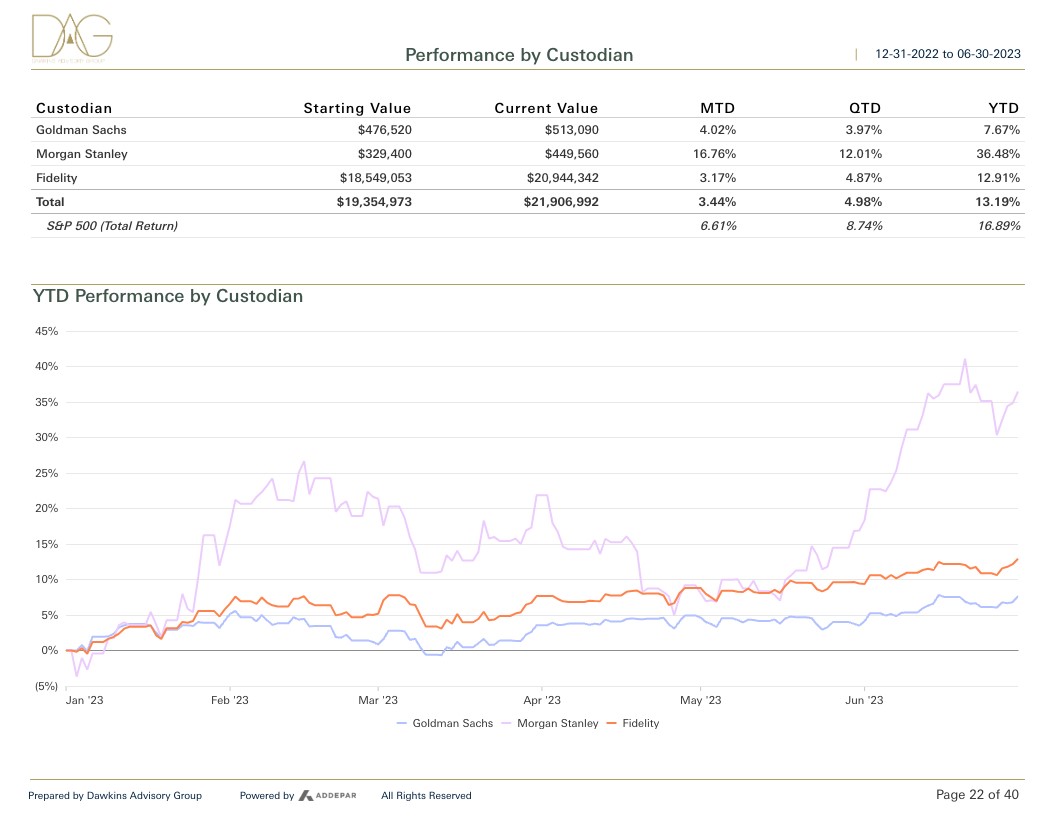

Robust reporting, tailored to you

Workflow Example - Asset Classification Automation

- Dawkins Advisory Group’s series of custom formula-backed attributes take Addepar 3rd party data (Morningstar, SIX, ICE) to automatically assign asset class and sub-asset classifications based on industry best practices

- Automation of manually managed, offline, Alternatives classifications using formulas

- Ability to override any formula backed designation (Additional customization can be specified to override specific positions for holding specific deviations.)

- Recurring Audits of Asset Classification Unknowns to ensure data integrity

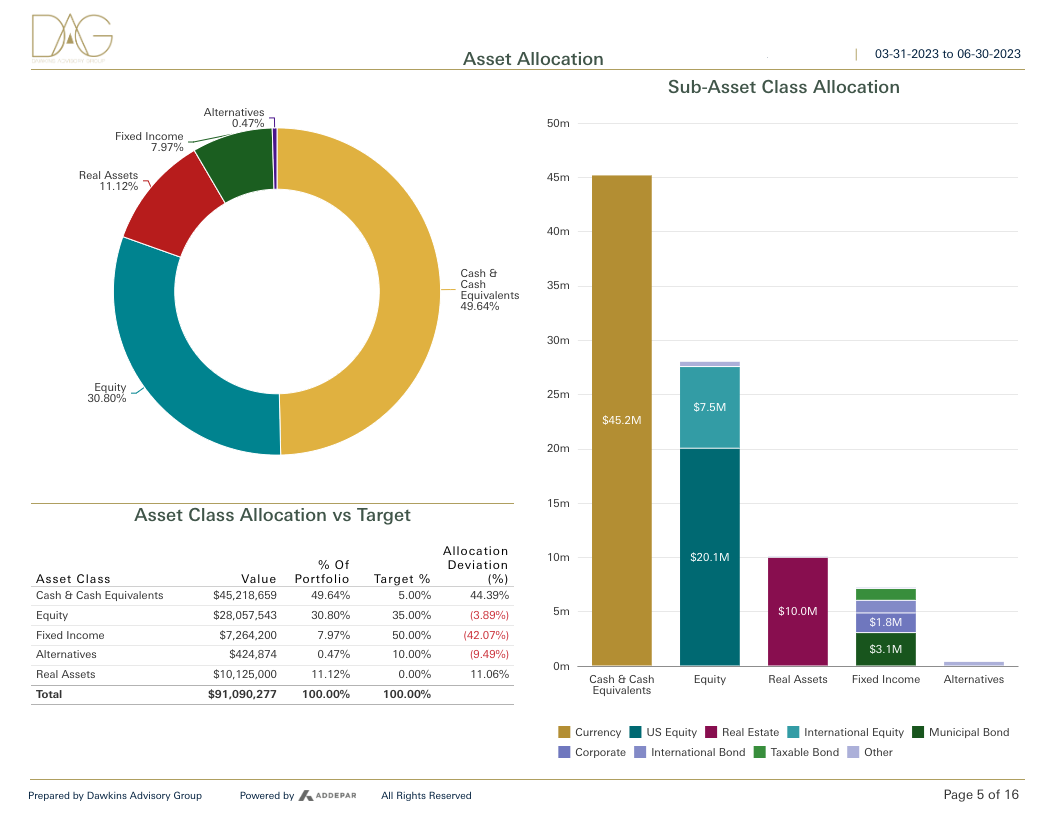

Dawkins Advisory Sample Reports